IN

IN

JPN

EN

Join Our Communities

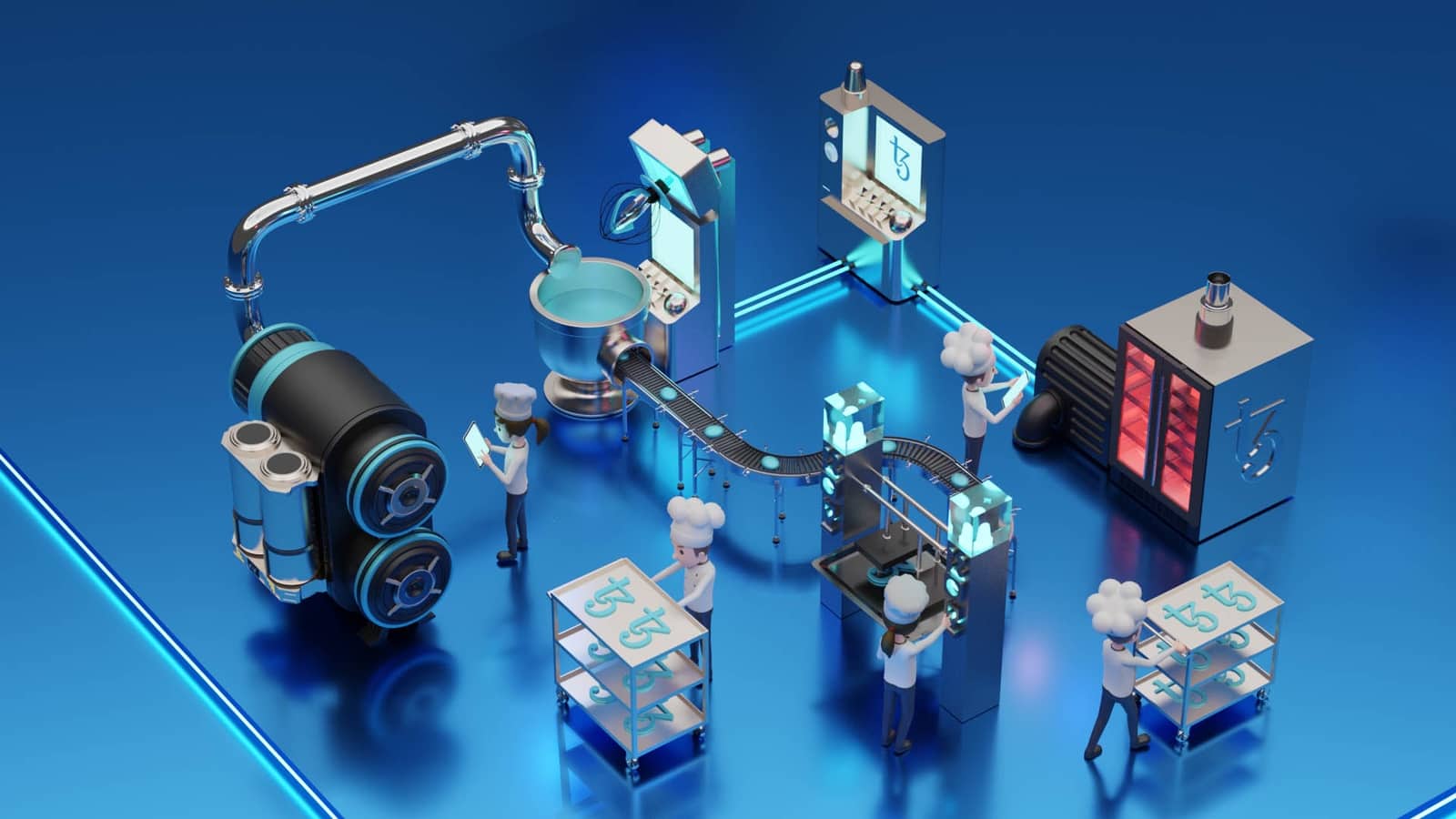

‘Baking’ is the term the Tezos blockchain network uses for signing and publishing blocks on the blockchain. Bakers help secure the network through their baking and stand to reap the rewards in the form of tokens through their baking work.

To become a baker and create a network node, you need to have holdings of at least one roll (currently valued at 8000 tez – Tezos’ native cryptocurrency).

Because Tezos uses a Liquid Proof of Stake (LPoS) consensus method (Tezos’ way of validating transactions, securing the network, and voting on protocol upgrades), individuals or organizations with less than one roll can delegate their tez to a baker and receive rewards.

And because Tezos uses a liquid methodology, those delegators are free to move their stake to any baker they choose, at any time.

With that in mind, is there a difference between being a regular baker and running a node and being a corporate baker? In short, no. But there are good reasons for corporates to create their own nodes and become a baker, including having a stake in the network, securing the network, and having a say in its future direction.

Becoming a corporate baker aligns with the time-honored [DD2] mantras of ‘innovate or die’. It’s also about being commercially savvy.

Suppose your company is interested in adopting a blockchain to build products and services off. In that case, it makes sense to want to have a say in the future direction of your chosen blockchain – and that’s exactly what becoming a corporate baker allows you to do.

Put another way; your business receives more control being a corporate baker with Tezos than it does over the latest Microsoft Office update on the company’s PCs.

For everyone else, having corporate bakers aboard the network makes sense because then enterprises vouch for and contribute to the network’s security – a huge plus for anyone wanting to minimize their risk around blockchain adoption.

By running a node as an enterprise and becoming a baker, an organization also sends a strong signal that demonstrates its trust in the network, creating a virtuous cycle where the company’s work feeds further confidence and stability, meaning the value the company receives by being a baker increases.

The number of nodes also helps in securing the network as well. That’s because the more people validating transactions, the more secure those transactions become. A greater number of nodes means that more nodes need to be attacked to hijack the network. In the case of Tezos, any company undertaking high-risk, high-value transactions should consider becoming a baker.

It’s also a win for any organization wanting to be seen as innovative and keeping up with the pace of new technology. Not only because it affords the business a say in the future direction of the blockchain, but also the hands-on experience it gives technical and product teams to create new services and products.

And the use cases keep growing: corporates can create their own smart contracts, mint NFTs, and bake other transactions with a greater certainty that the network will accept those transactions. Additionally, a company baking its own transactions won’t get charged gas fees, as all the computational work and verification can happen on the node the company operates.

Being a corporate baker also means those transactions don’t have any third-party dependencies. Running a full-time node means baking other transactions on the network, which means you can charge gas fees, earn tokens for securing the network, and have non-bakers delegate their tez to the corporate network.

Being a decentralized network, there’s no central authority, but bakers need to comply with the laws of the nation they are running their node in. A key part of these laws are regulations dictating that an organisation knows its customer (KYC) and adheres to anti-money laundering (AML) best practices.

This is where the mempool comes into the picture. A mempool is a set of all pending transactions on the network, with transactions being broadcast through the network via the nodes.

Every node can have a different mempool to its peers, and bakers can choose any transaction they like from the mempool – this means they can choose transactions compliant with their local regulations.

Mempools, however, don’t have to be public. Private mempools let a transaction issuer conduct operations on a private server, such as transfers and smart contract deployment. That server is only accessible to a group of select bakers authorized to validate the operations on that particular private node.

These private mempools can be set up to comply with local regulations, meaning that anyone issuing a transaction can use the private mempool to make sure their transactions are not being validated by an unknown or blacklisted party, such as North Korea or Iran.

Corporate baking also works well in terms of the fact that baking is predictable. Tezos’ Liquid Proof of Stake mechanism makes it easy for bakers to predict, with reasonable certainty, which bakers will be selected to bake a new block. This means transaction issuers have good foresight into who will validate their transactions in the following two weeks.

And because Tezos is built around a baking reward model, a baker’s stake in the ecosystem is not diluted. It works this way: 80 newly minted tez are rewarded to bakers at each block. The baker producing the block and adding it to the Tezos blockchain gets 40 tez, while the 32 bakers validating a block get 1.25 tez each.

Finally, companies can take part in the network governance by voting on changes and upgrades. Voting power is determined by the number of tez a baker owns, along with the number delegated to it.

Liquid Proof of Stake also means bad actors on the network are punished, so if they double bake or double endorse, they are blacklisted, and not able to participate in the voting process. Therefore, corporates can be assured of the proper governance of the network. This is because delegated tez are ‘liquid’ (i.e. aren’t subject to a lock up period), delegators are free to call out any malicious activities, even if it means accusing the bakery they have staked their tez to, as it will not come at their own expense.

There are dozens of corporate bakers on the Tezos network. These companies are all gaining experience in running nodes, validating transactions, earning gas fees, and acting as delegates for other individuals or organizations without the necessary tez to create a node. As bakers, they are also able to vote on protocol upgrades, as well as taking part in securing the network.

One of the most notable is Ubisoft, a gaming company best known for its Assassin’s Creed series. It has become a corporate baker to gain experience with the network, mint NFTs, and undertake activity to secure the network.

Others include:

The Blockchain Group / Blockchain Xdev

SmartNode, which has undertaken to stake tez at low commission fees. It also has a simple solution for accessing tez through prepaid cards

Taurus, a management firm allowing customers to digitize and tokenize any type of private assets

Wakam, a provider of digital insurance products in Europe. It became a corporate baker to better understand the potential for insurance on the blockchain

Smartlink, a decentralized escrow smart contract platform built on Tezos

South Korea’s DSRV Labs, the nation’s leading validator and infrastructure provider for blockchain networks

Stakefish, a leading staking service provider supporting multiple blockchain products

Sygnum, the world’s first digital assets bank offering staking services for Tezos

Exaion, a cloud provider of blockchain solutions and high performance computing

What does the future hold for corporate bakers on Tezos? We’re going to see increased interest from enterprises wanting to take their claim on this cutting edge technology, placing them at the forefront of developments in blockchain, smart contracts and NFTs. The companies mentioned above are just the forerunners – so watch this space.