IN

IN

JPN

EN

Join Our Communities

The evolution of the nascent Web3 space hinges heavily on the success of its dynamic and innovative startups, which work tirelessly to develop the space. In turn, many startups rely on venture capital (“VC”) funding for their survival and growth.

Despite its critical role in fueling this digital transformation, the inner workings of the VC landscape remain shrouded in mystery to the very entrepreneurs it seeks to empower.

This article pulls back the curtain, shedding light on the startup funding and VC ecosystem, featuring a raw and unfiltered discussion around its operations and the mindset of its key players.

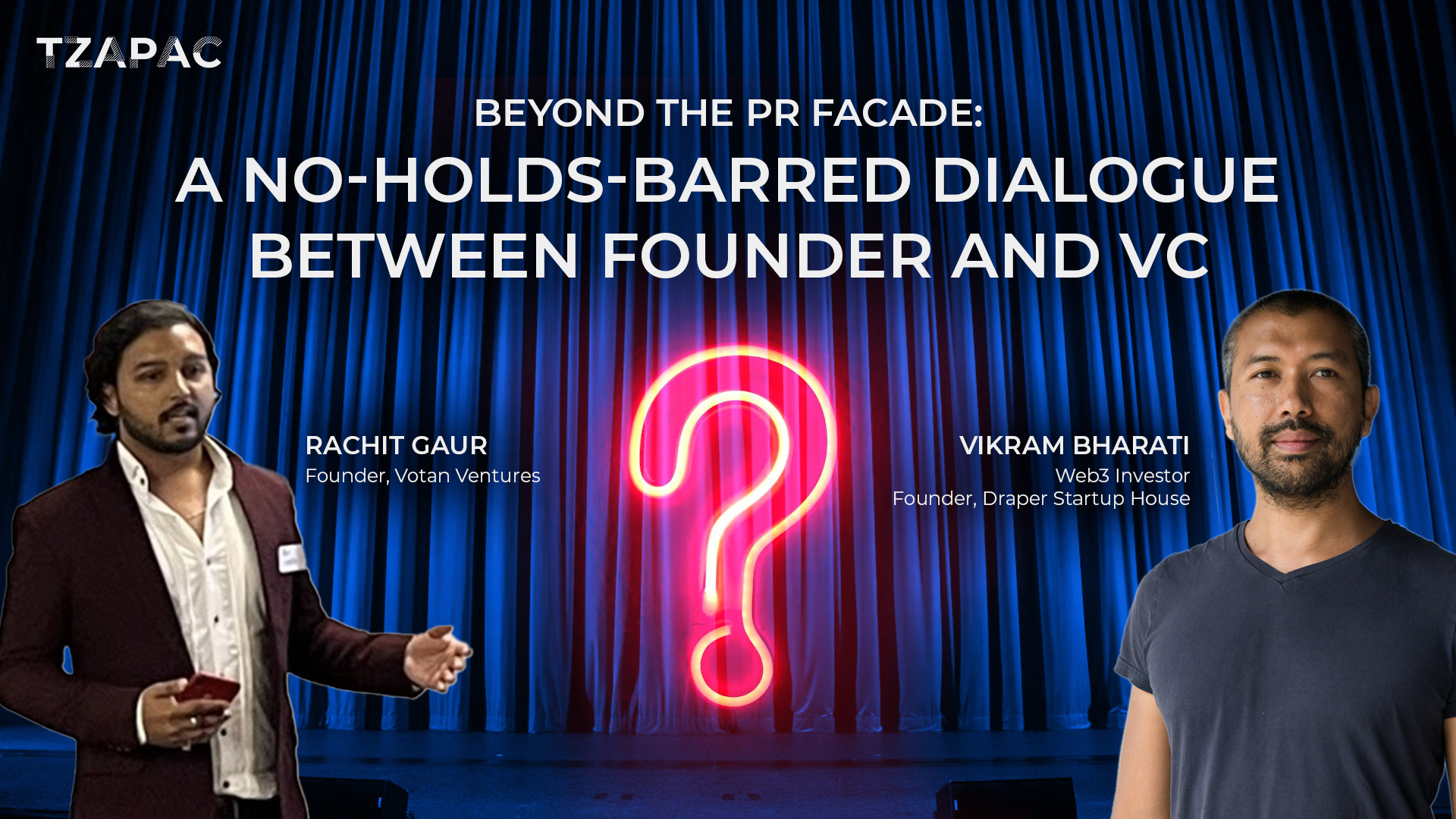

Join Rachit Gaur and Vikram Bharati, a Web3 startup founder and founder of Draper Startup House respectively as they explore the burning questions that startup founders grapple with daily.

How do VCs truly operate? Are the intentions of investors at Demo Days genuine, or are they truly there simply for networking or free food? Why do venture capital investments so often seem to occur through connections, and how can startup founders navigate this landscape to attract investors effectively?

As they delve beneath the glossy exterior of venture capital and startup funding, they provide crucial insights and invaluable guidance for Web3 founders to navigate this complex space with more clarity.

Technopreneur and enterprise architect Rachit Gaur is passionate about solving problems and impacting the world through creating Web3 solutions. He is also the founder of Votan Ventures, winner of the Microsoft Century Program and recognised by NASSCOM and the Government of India for their work. They have also been shortlisted for the Innovate for India Program by MG Motors.

Their tool, VChained, is pioneering a sustainable future for the supply chain industry. Their no-code tools give companies and consumers end-to-end traceability of products, carbon footprints and smart data insights. Through blockchain-verified data, VChained empowers companies to finally achieve net zero emissions.

After launching their traceability MVP, VChained has onboarded 3 beta customers, including MG Motors and Asia’s largest B2B pharmaceuticals marketplace.

They have also been shortlisted for the Leap to Unicorn program by CNVC and IDFC First Bank, as well as the Maruti MAIL Program hosted by GHV Ventures.

Learn how you can trace your business to a sustainable future with VChained.

— Votan Ventures (@votanventures) November 21, 2022

Explore the importance of traceability in the $50 trillion industry.https://t.co/Yr3uxQi0CN#votanventures #vchained #blockchain #blockchaintechnology #tezos #carbonfootprint #logistics #supplychain

Rachit also invites all startup founders and VCs to join his #NOTIME community - explore collaborations, find initial customers for your business, and build traction.

Vikram Bharati is the founder of Draper Startup House, has previously led VC Investments at REAPRA Group, and has participated in the TZ APAC Tezos Incubator as a mentor and masterclass host.

Draper Startup House is on a mission to create 1 million new businesses worldwide through its global business ecosystem. With presence in 7 countries across Asia, they are committed to supporting entrepreneurs across the region.

✅Provides clarity on company-wide goals

— TZ APAC (@TzApac) February 20, 2023

✅Provides inspiration

✅Is easily communicated

Here’s @dshglobal founder @vikbharati enlightening startup founders on a great mission statement in a masterclass during the last cohort of the TZ APAC #Tezos Incubator. pic.twitter.com/bUpnQihZOT

I appreciate the opportunity to speak with you, Vikram. As you know, I’m the founder of Votan Ventures, and our tool is called VChained.

We’re proud to be part of the TZ APAC Tezos Incubator’s inaugural cohort. The TZ APAC team has been incredibly supportive, helping us refine our pitch and pivot from a supply chain management focus to carbon footprint calculation.

Our traction grew after Demo Day. We gained our first customer at our first pitch event which gathered numerous startup founders and VCs like you. Although they began with a free trial, it was an important step for us.

Through the TTI, we learned a lot about pitching, Lean Canvas models, and business models, so we didn’t have to rebuild or iterate much after that - and we didn’t see too much value in joining other incubator programs.

Since then, we’ve connected with industry professionals in various sectors who are greatly interested in how our solution can help them provide traceability in carbon footprints, enabling accurate emission calculations.

Although we’ve had really good traction, we faced customization challenges with our first customer, which led me to seek VC funding.

I believe that VC funding is one main challenge that most startups face - and that brings us to today’s conversation. I’m grateful for this opportunity to explore the startup and funding space from your perspective!

I’ll try to share as much as I can, and do my best to be of any value and help here.

We often read headlines about startups raising millions or billions of dollars on a pitch deck, especially in recent years with the growth of Web3 and blockchain. There’s a lot of money circulating, and we probably have friends who have raised millions with essentially no product right? This is the stuff we see and hear all the time.

Before we begin, let me give you some background on the venture capital market in general.

I think it would be beneficial to understand how the VC business works and how money flows in different times, places, and locations.

It helps startups realize that there isn’t an infinite pool of money waiting to be invested.

The Dutch word for venture capital, "durfkapitaal," translates to "adventure capital," which captures the essence of venture capital well. It's for the adventurous, with the odds of success being the lowest in any investment category.

Veteran investors who have figured out the business can succeed, just like some gamblers who always win because they know their craft - what and where to play, when to stop, and so on.

So, venture capital is the riskiest form of investment because it’s the earliest stage.

Let’s start with where the money comes from.

VCs need to raise money from others too. I’ll illustrate this with an example.

If you want to start a VC fund to invest in blockchain, you’ll have to pitch to someone who manages, let’s say, a university endowment and allocates capital to different asset classes.

So this fund manager might be investing in the stock market, pensions, and other funds. He might be thinking, “I need some exposure to venture capital; to blockchain, which is the new industry.”

So now, you have to go to him to convince him that you’re worth investing in. You’ll need to present your returns, portfolio, and track record.

What most startups don't realize is that VCs know the fundraising game because they need to fundraise for their own funds in the first place.

I’m currently fundraising for my second fund, and I gotta tell you - it’s not exactly the most enjoyable process.

I’m in the market, talking to hundreds of people every month - cold emailing, attending networking events, researching people. I’m trying to get a meeting with these people, to convince them to give me money which I can then invest in startups with.

Down the chain, people are doing the same to me. But up the chain, I’m doing the same, right?

This is probably the least understood thing about venture capital. They have to go and raise money. And I’d say most VC funds fail because they cannot raise money.

This is very relevant right now, with the whole Silicon Banking Valley banking crisis. People get scared, they try to move their money from banks into gold, and they pull their commitments to funds. So now, I’ve got to pull my commitment to investing in your startup because someone has pulled their commitment to my fund.

That’s just one aspect of how the money flow stops, and so it’s a very complicated and difficult game for a venture investor.

Now, the last few years have been very different - an anomaly in the history of money, with zero interest rates and governments printing money. So with all this money sloshing around, we’ve got stories of pitch decks raising $100 M, and that’s only happened in the last 3-4 years.

It’s never happened before, and now that money flow has stopped. The bubble created by easy money has burst, which will have cascading effects throughout the industry.

So anyway, I just wanted to paint the picture of how venture capital generally works, because it is a complex and challenging business. We only hear of the success stories, and most venture funds don’t even return their capital back to their investors.

These are great insights!

It’s helpful to understand the industry we’re in, especially from the other side of the coin.

I’d like to talk about Demo Days.

I’ve seen incubators work tirelessly to prepare pitches and projects for presentation to VCs like you, often within three to ten minutes. However, I’ve noticed that very few investments are made at the incubator level, with more investments happening at accelerators.

So, what do you think is the mindset of VCs when attending incubator Demo Days?

When I go to Demo Days, I’m definitely looking for investment opportunities. But I can only speak for myself and not for all other investors.

While we’ve made fewer investments from attending Demo Days compared to those made from warm introductions or other methods, they definitely do exist - we’re still invested in several companies that we’ve met at Demo Days in the past year. Just this morning, we invested in a startup we met at an online Demo Day a few months ago.

There are times when I attend Demo Days without the intention of investing.

Perhaps because I don’t want to upset the person who invited me, or I’ve already looked at some of the companies and didn’t find them interesting.

But even if we don’t have capital available at the moment, we’re always looking for companies to invest in. The reason for this is that there’s a cycle to fundraising.

When I talk to potential liquidity providers, they ask about what our pipeline looks like. So, having good quality companies in our pipeline is important for us to raise funds.

We’re always on the lookout for promising startups to invest in, and the situation can change rapidly - I could close my fund tomorrow and suddenly have a lot of money to invest.

In summary, when I attend Demo Days, I generally look for companies to invest in. There are times when I go without the intention of investing, but those instances are rare.

Thanks, Vikram.

My intuition is that some of the Demo Day attendees aren’t interested in doing anything at all. They’re just visiting for networking and the sake of maintaining relations.

I’ve also made friends with a junior VC at a fund, who told me that he has quotas to fill - for example, evaluating 100 startups in a month. This means they don’t actually go through the pitch thoroughly but just do it for the sake of hitting their quota.

Is this regular practice?

Yeah, for sure.

Venture capital is a business, and they need to make money. The employees of this business - the analysts, and associates - like any other job, have KPIs. They have to check the boxes.

Investors get invited to Demo Days all the time. Even if you’re a no-brand venture investor without a track record, you still get invited to Demo Days. You certainly can’t go to all of them - especially the senior folks.

You have to train your junior folks, so you send and empower them. I’d say probably most of those who go to Demo Days are probably juniors, who have to learn on the job and meet goals, KPIs, or referrals.

And I think that’s absolutely okay!

Sometimes you learn the hard way, but I would say most of the folks who go to Demo Days are probably not there to invest. They’re there as part of their job, learning, and networking.

The situation may be different for a Y-Combinator Demo Day, which is sort of like the Holy Grail of Demo Days. But there are thousands of incubators and accelerators, and they may not have the same prestige and network of investors.

So I would say that you’ve got a very accurate reading of the situation.

You know, I go to a lot of Demo Days. I see the same folks there - and they’re like oh it’s free lunch or dinner. They’re there for the food, but you know, I feel that’s okay!

You might meet someone who’s not there to invest but it may turn out to be a very serendipitous meeting. It’s interesting how these things work out.

Instead of having high expectations of securing investments from investors at Demo Days, startup founders should be looking at it as an opportunity to hone their pitching or public speaking skills, or to gauge interest in their startup.

That’s what I tell our founders: Don’t expect investments.

You know, raising capital is very hard, but take every opportunity to just get better at selling, without any expectations.

So now that we’ve established that Demo Days work, although in a small limited quantity - I feel that by depending so much on warm connections, VCs miss out on so many great startup investment opportunities, maybe even the next unicorns.

So I’d like to ask for your insights into why VCs rely so much on getting leads from their connections.

Ultimately, it’s a business run by humans. Humans like to have confidence in the people they’re investing in, and they want to get to know people first.

If you look at Japanese investors and the way they get to know their potential investees, there’s a lot of time with them, going to lunches, dinners, and drinks. So I think every culture is different.

Every VC has its own way of doing it. To be honest, I don’t know if there’s a right way of doing it - especially at the early stage.

Once you get to series A and B then, then it becomes a game of numbers and figures. The top-quality companies in these stages are already on the radar of investors. That game is slightly different.

But in the early stage, where you have an MVP and it depends on your charm and your ability to tell a story, this is business very much driven by human emotions.

Finding startups to invest in is like dating, you know.

In some places, you’ve got to go on a thousand Tinder dates to find someone that you like. But if you’ve got friends who share a similar culture and values to you, they probably know people like that too. So through them, you’ve got a better chance of finding someone who fits - and this makes your life a lot easier.

So, however you look at it, in the VC business there is very much a human element that you can’t remove from the equation.

Ultimately it’s about relationships. And it’s about convincing people that you’re worth taking a bet on.

Sometimes it’s very easy. Sometimes it’s very difficult.

I honestly don’t know if there’s an exact formula but I think you’re better off getting to know more people and making more friendships.

The more people you know, the more networks you have, the more friendships you have, and the more relationships you have.

I think that’s not a bad thing!

Previously, you spoke about how a VC company is a business. I have a habit of trying to understand the market or the business of a company.

According to a recent survey, out of 851 pitches, only 12% reached the due diligence stage and only 6% resulted in done deals.

So, is this a good funnel? Do you see a flaw in this market, and do you have any ideas to make it a little better?

Yeah, I think it’s an interesting question.

To be honest, I actually feel like those stats are too high. Maybe they’re right, but if it’s 6% - wow, I would say that’s a very good number.

I think it’s much, much less - probably 1-2%, in my experience.

Okay, I’ve raised capital probably 8 times in my life for various reasons - for Draper Startup House and for my previous companies.

But if I were to build another company, I think raising venture capital is something I would never do again. Ever.

Now I know the venture capital business. I’ve been on both sides - I’ve raised money, I’m investing money. So, I feel that I have a holistic experience of venture capital from both sides.

And if I build another company, I’m going to bootstrap it.

The only situation where I would raise money is where I already have the right business model, and it’s just about scaling the company.

But in the early stages where I’m finding product market fit and defining the business model, then I wouldn’t raise money. That’s just my personal thoughts about raising capital.

From what I’ve seen in the market, many startups are in the business of building a startup because they just want to raise money. Fundraising becomes the goal - building the company and improving lives with products and services becomes secondary. That’s not a sustainable environment for business building.

People get enamored by all these great stories of people raising money, and that becomes the goal. This creates bubbles and fraud - a very toxic environment. I think this is a flaw on both the founder and venture sides.

You know, I’ve recently been thinking about money like it’s water. Rivers flow downstream, always trying to go to the ocean because that’s its natural state.

Anywhere in the world, everyone is always looking for returns. So, money’s natural environment is where it can grow - basically, where all the returns are. And that’s where the money is trying to flow to - whether it’s China, Russia, or anywhere else.

So, if you’re not able to raise money - is it an issue with the money or is it an issue with the company?

Money is always on the lookout for opportunities, and if there’s a solid business with a great model and circumstances that encourage money to flow into it, the money will find its way there.

When fundraising, it’s important to ask yourself if you’re the one placing obstacles in the way of money coming to you. Is it your fault, or is there a problem with the money itself?

I think money’s always money. It’s always going to be looking for returns. Maybe the issue is that we’re putting rocks that block the flow and we’re becoming the obstacles to money flowing into the company.

I’m fundraising for funds too, and I’m not having an easy time. So I’m asking myself - what obstacles am I placing in front of money that’s trying to flow to me? Perhaps my thesis on the fund is terrible, and that’s why no money’s flowing in. Having difficulty raising money is my problem, not the money’s. The money is there, seeking to flow toward me.

I can’t control the flow of money. It has its own natural physics. The only thing I can control is how I position myself so the money flows to me.

Anyway, I just want to share that because that’s what I’m thinking about at the moment while I’m fundraising too.

All right. That makes a lot of sense. You mentioned that if you were to start again, you’d have bootstrapped. Let me share the obstacles I’m facing in my journey right now as a bootstrapped startup.

I feel like I’m in a vicious cycle - to secure funding I need customers, and to close deals with customers I need funding.

It’s encouraging that investors frequently tell me that they can clearly see the need for VChained - that our solution is right on time since relevant regulations will be implemented in 2024. But they also tell me that we’re too early-stage for them and need customers first.

While we do have very interested customers who we can truly help, the issue lies here - I’m 100% bootstrapped, so I don’t have pockets deep enough to customize the solutions as to how they need them.

I’m struggling to break this loop. Perhaps I’m not connecting with enough VCs.

Could you share what you feel should be a good benchmark in terms of how many VCs founders should be reaching out to?

From my experience, you should be speaking with 300-400 investors.

And I don’t mean simply sending cold messages to them.

It’s a very competitive space right now. You have to be jumping on a call, or having a conversation with a minimum of 100-200 investors.

That’s what I’ve observed from all the successful startups that I’ve seen who have raised money in challenging times.

There are startups that talk to just a few people and get money. But those are exceptions.

What is the ideal way to reach out to VCs?

There is no ideal way here.

If you’re looking for a formula - there isn’t one.

I think this is the great thing and the bad thing about entrepreneurship, right?

People will tell you that there’s a formula, you have to do things in a certain way, write a certain thing… sure, there may be some tips here and there, but there is no clear-cut formula.

You have to create your own formula to reach out to people.

I think instead of chasing investors, you should be thinking about creating an environment where investors come to you. That’s the strategy that many startups don’t apply.

Do you mean personal branding or things like showing traction?

If you have a good product or service, and a good business model, capital will chase you because they will get returns - as we spoke about earlier.

So, just have to put yourself, your product, and your service out there in the market for people to see.

Right now, it’s the easiest time in history to raise money. Now you can be on Twitter and so many other platforms where you can be noticed.

Cold calling, chasing folks - you have to do all that conventional stuff.

But what can you do so investors will come to you and say “I need to talk to you?”

They should be chasing you - to be stalking you and lining up to meet with you.

What are the circumstances that you can create to make that happen?

It’s going to take time. Sometimes, it can take up to two years to raise the first check.

It’s difficult, but if you can focus on building a product or service that can clearly return money to investors, it’s going to be a lot easier to raise.

Thank you for your guidance!

I was quite intrigued by your sharing of the venture capital industry earlier.

You pointed out that most investments fail - and from one entrepreneur to another, would you be able to share any thoughts on how the VC and startup ecosystem can be improved, especially in the growing Web3 space?

Venture capital is a very new phenomenon - do you know how old it is? Let’s do the math.

Before the Internet, investments were heavily geared towards hardware and electronics, which required a different approach - often involving the establishment of factories and physical production lines.

It was only around the late 1990s that venture capital truly took off, with the rise of internet startups. So, if we consider that point as the start of modern venture capital, we could say it’s about 25 years old.

So it’s really only in the Internet age that venture capital has truly flourished, especially in the last 10 years with the advent of blockchain technology.

This period coincided with an era of unprecedentedly low-interest rates, essentially free money, which has further fueled the growth of the industry. The last 10 or so years have been particularly transformative due to this zero-interest rate environment, which started around 2009-2010, following the financial crisis of 2008.

So, half the time that modern venture capital has been in existence, it has been supported by this environment of free money.

So I think it’s difficult to draw definitive conclusions about what makes a good business or investment within the venture capital space. We don’t have enough historical data in a variety of different economic environments to make such determinations.

In recent years, the number of people becoming VCs has exploded. There used to only be a handful. Draper Startup House is named after Tim Draper and the Draper family. They were one of the original VCs in the world, investing in semiconductors, way before the Internet.

So, they kind of built the VC business. They took VC out of the US, being the first ones to invest in India and China. They took the GPL fee structure to India, and they invested in Tencent and the first wave of Internet companies in China. So the Draper family has been in the venture business for a very long time.

They’re pioneers - but I’d say 80% of the VC companies today are new. That’s great because it means more investors, so it’s great for founders and whoever’s raising money.

But yeah, venture capital is a very new industry. And I think we don’t have a complete picture, because half of its existence has been in this era of free money.