IN

IN

JPN

EN

Join Our Communities

“Airavat, buy 100 tez for me at the best price across all exchanges. Stake it, and use the collateral to borrow USDC. Use it to diversify my portfolio according to my risk profile.”

This is how users can leverage Airavat to perform complex tasks across crypto ecosystems.

Participating in DeFi can be a truly frustrating experience: Bridging tokens across chains, dealing with network errors and unreasonably slow response times - only to facepalm when you realize you need to swap and bridge more coins to cover gas fees.

Users no longer need to risk their time and increase their blood pressure levels, with Airavat’s ability to seamlessly automate individual tasks with simple commands. Entire crypto ecosystems are connected in a single interface - Telegram, the crypto community’s platform of choice.

What does this mean for the crypto world? If it isn’t clear enough, let us flesh the value of Airavat out.

Crypto-intelligent AI with a ChatGPT-like interface, natively integrated into the 4th most popular messaging app in the world

Delivers trading strategy tailored to the user’s risk profile and automatically executes it

Opening up gateways across currently fragmented and silo-ed blockchain ecosystems

In sum, Airavat makes crypto accessible to all. Seasoned DeFi participants can enjoy one-click convenience, and new users can benefit from the clarity and education it offers.

Airavat’s journey toward being the premier AI-powered utility DeFi chatbot is well underway, having successfully captured the attention of prominent investors, leading to a successful pre-seed funding round of US$165,000. The crypto space’s firm confidence is also indicated by almost US$100,000 in grants received from the Polygon, Harmony, and Mina protocols.

And of course, Airavat is now integrating with the Tezos ecosystem - from participating in the TZ APAC Tezos Incubator and releasing exciting Tezos-specific offerings like USDC/USDC borrowing against staked tez.

Being a part of the @TzApac #Tezos Incubator as one of the 14 innovative startups is another feather in the cap for our awesome team!

— Airavat (@AiravatBot) April 3, 2023

It's a validation of the work that has gone into BUIDLing. We're excited to take advantage of this opportunity to scale things up and take it to… https://t.co/vKldHsqpt6

The dynamic and rapidly-changing nature of the crypto world may be intimidating to many, but not to Airavat.

Its sharp understanding of the space is derived from the application of machine learning models to process a myriad of data sources, from whitepapers to crypto news feeds and trading sentiment data. Tapping into real-time data, Airavat stays up-to-date with the latest trends and market fluctuations.

Consequently, users gain an intelligent ally at their fingertips who can answer their technical questions and provide insights into trading signals and market sentiment.

Imagine having a personal financial advisor with complete knowledge of all things crypto, who understands your risk appetite, and continually offers strategies tailor-made for you.

That’s precisely what Airavat promises with its AI-based portfolio allocation feature. Here’s how it works:

Airavat initially assesses the user’s risk profile through a series of questions. Based on the responses, it suggests an allocation across different asset classes – reserve assets, higher-risk tokens, or passive income investments. With one click, users can choose to execute this recommended strategy.

But the magic of Airavat doesn’t end there - it evolves to become a smarter companion over time. As it learns from your behavior, it enhances its recommendations, resulting in a personalized trading assistant that continually adapts to serve you better.

Airavat’s potential extends beyond trading and portfolio management. It also serves as a front-end assistant for Airavat’s Initial Telegram Offering (ITO) product, a launchpad to help projects raise funds through Telegram.

Airavat guides users through the onboarding process for the ITO, answering their questions about the project, the team, tokenomics, and the roadmap. It even assists with the necessary steps, such as KYC, staking, and whitelist requirements.

With their vision of being a mega-aggregator of various CeFi and DeFi products, platforms, and networks, Airavat eliminates the chaos by enabling transactions in one user interface.

Various CeDeFi building blocks are used to facilitate optimal assembly and routing of tasks across platforms, accomplishing user tasks in the most efficient, cost-effective manner.

Airavat may be in its Limited Beta stage, but it is already showcasing its potential.

It connects users with centralized exchanges like Huobi and Binance, decentralized exchanges like Uniswap, Quickswap, and Traderjoe, and even networks like Tezos, Bitcoin, Ethereum, Polygon, Avalanche, and Tron. NFT Marketplaces like Opensea, Rarible, and AAVE are also within easy reach.

Users can benefit from swaps across more than 600 USDT trading pairs, offering unprecedented choice and versatility. Moreover, staking is available for Ethereum (ETH), Polygon (MATIC), and Tezos (XTZ), indicating Airavat’s commitment to a diverse range of popular and powerful tokens. The network support is just as robust, covering Ethereum, Arbitrum, Polygon, and Binance Smart Chain.

Transacting across different coins, protocols, and networks is no longer a labyrinthine task. Airavat provides a single-hop bridge, enabling any-any swaps and borrow/lend actions.

With a market spread across multiple platforms, finding the best price can be a challenge. But not with Airavat, which uses its broad network of integrations to offer real-time best-price discovery.

Airavat isn’t just about convenience - it’s about capability. It supports all standard crypto exchange functions, including spot and spot margin trading, futures and options trading, staking, and lending/borrowing.

Beyond standard features, Airavat also introduces innovative offerings like bridge-staking and spread orders. It also allows users to execute repeat actions over time and across exchanges - a sophisticated level of strategy orchestration typically only available to institutional players.

Typically, turning your digital assets into traditional money or vice versa involves navigating through several platforms. With Airavat, this tedious process is transformed into a breezy experience. The facilitation of seamless conversions between fiat and crypto gives users the ability to easily move with the market’s pulse.

The integration of Tezos into the Airavat platform represents a fusion of unique capabilities that enhance each other’s strengths.

Tezos’ Liquid Proof-of-Stake (LPoS) consensus mechanism is a key enabler for Airavat’s staking and borrowing features. It allows users to stake tez and earn rewards, while also providing the flexibility to unlock the value of these staked tokens through Airavat’s borrowing feature.

Airavat empowers Tezos users to unlock the latent value of their staked tez collateral. With Airavat, users can borrow USDC/USDT against their aXTZ liquid staking token. Through this offering freeing up an otherwise idle asset for investment and capital growth, we can expect increased transaction volumes and potentially enhanced liquidity/market depth within the Tezos ecosystem.

The Tezos blockchain’s high throughput and low transaction fees make it an ideal platform for Airavat’s swift bridged trading and derivative offerings, ensuring that users can execute transactions quickly and cost-effectively.

Jumping from USDT/USDC or Fiat to Tezos or FA1.2 tokens can now be done in one smooth hop, and within an impressive 30-second timeframe. Airavat eradicates the multi-step processes typically associated with such operations, saving users precious time and effort.

The integration of the Tezos blockchain into Airavat is looking to set the pace for future blockchain innovation, making the Tezos ecosystem an even more attractive proposition for those venturing into the crypto landscape.

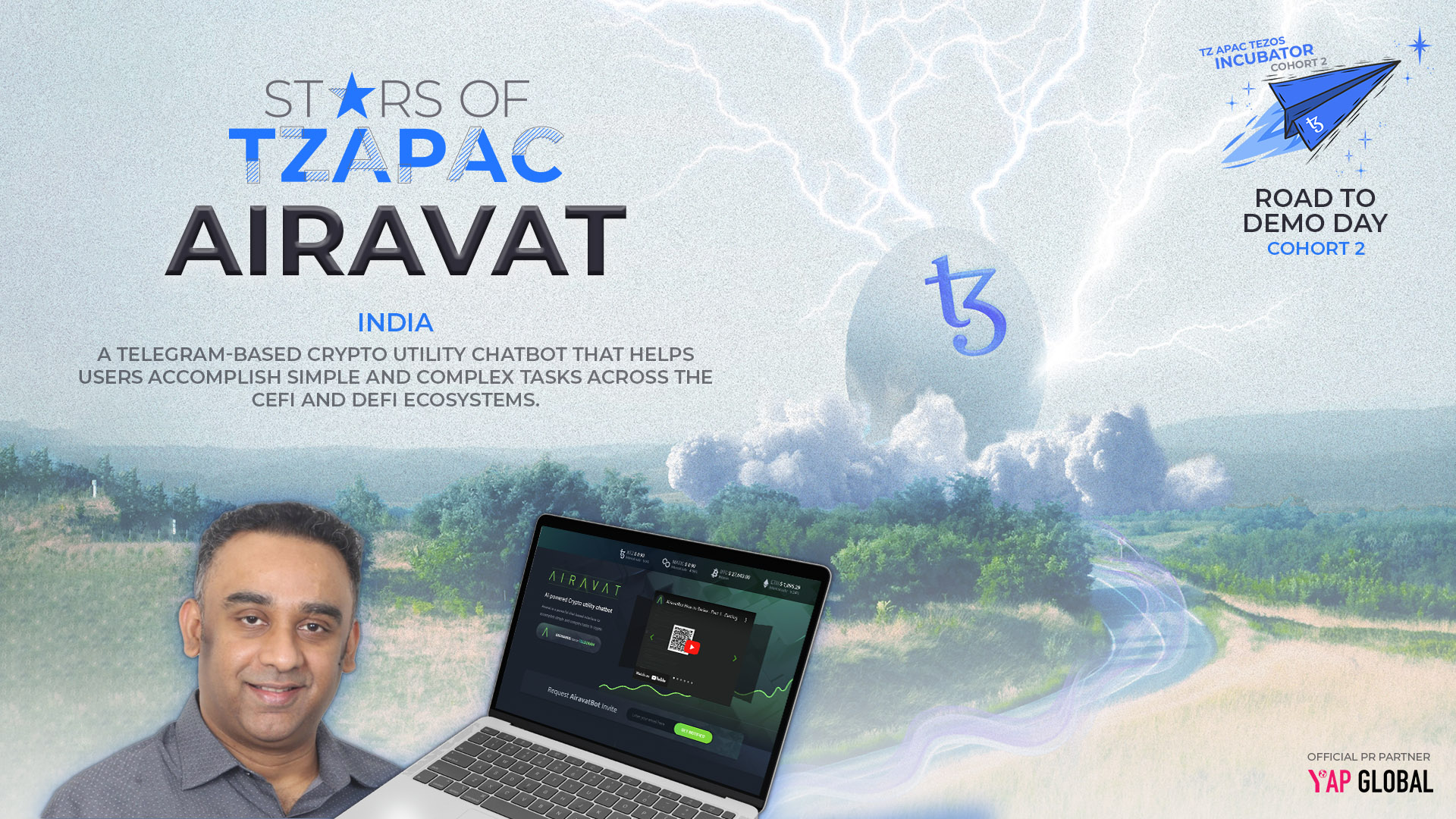

At the heart of Airavat is a visionary dedicated to contributing to the crypto world - Gautam Sampathkumar.

"Our commitment to building a cost-effective exchange infrastructure, regardless of market conditions, has led to a platform that scales seamlessly with active users. Even with a lean team size that varies between 1 and 5-6 members, we remain undeterred - our progress continues to march on. Through sunny bull markets and even during what we now term as 'crypto winter,' we stay the course." - Gautam

With over two decades of invaluable experience in both engineering and leadership roles within Silicon Valley and the Crypto sector, Gautam has consistently demonstrated his talent for creating successful, robust, and innovative enterprises.

Gautam’s portfolio of achievements includes the founding of Lakshmi Capital, a successful crypto-mining operation that established GPU and ASIC mining facilities in India, Canada, Russia, and the US. Despite the biting cold of the crypto winter, Lakshmi Capital mined over US$1 million worth of crypto, a testament to Gautam’s strategic planning and execution.

Then there’s Indra Development Services, a mid-six-figure blockchain development, consulting, and advisory firm that Gautam established. This venture further showcased his deep knowledge of the blockchain industry and his ability to provide strategic advice that drives growth.

Yieldwallet.io is another testament to Gautam’s industry expertise. As a Staking-as-a-Service provider, Yieldwallet.io ran validators for Tezos, Polygon, Harmony, and Mina. At its peak, it handled a delegation of $9 million, generating mid-six-figure revenues and gross profits.